CABINET EXATIS 33

Decennial Insurance and DO

Decennial, damage to the work

Biennial and ten-year guarantees for construction damage

Certain defects hidden at the reception and causing serious damage are covered by a guarantee of ten years after the reception.

The items of equipment are guaranteed for two years.

These guarantees make it possible, when a disorder is noted and falls within the scope of guaranteed damage, to obtain compensation, without having to provide proof of the manufacturer's liability, this being presumed.

This presumption of responsibility can only be ruled out in the event of force majeure or the act of a third party involved in causing the damage.

The implementation of these guarantees is ensured by the recourse to the damage-works insurance obligatorily taken out by the contracting authority.

Otherwise, the manufacturer's liability insurance can also be implemented. In the absence of one or the other of these insurances, the guarantee is due by the persons deemed to be the constructor.

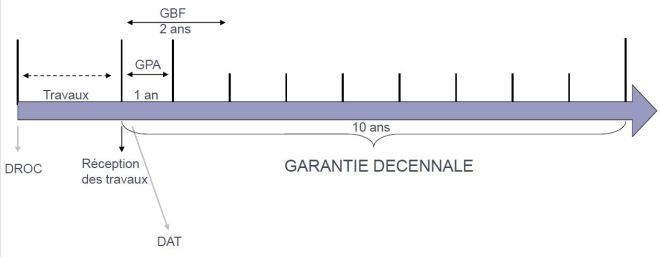

Guarantee period

The warranty period to repair damage within ten years

The warranty period is ten years reduced to two years for separable items of equipment.

The starting point is reception.

The warranty period cannot be reduced or suspended. However, it can be interrupted by a court summons or by an acknowledgment of responsibility.

DOC: Declaration of Site Opening

DAT: declaration of completion

GPA: guarantee of perfect completion

GBF: guarantee of proper functioning

Biennial guarantee

Nature of damage covered by the two-year warranty

All damage to equipment items is covered by the two-year warranty, except in two cases:

- when their failure renders the work unfit for its intended purpose;

- when, inseparable from a building, their solidity is reached.

In both cases, they benefit from the ten-year guarantee.

By inseparable is meant the elements whose removal or replacement cannot be carried out without deteriorating the building (for example: a pipe embedded under the tiling, a sealed marble coating are inseparable).

Ten-year guarantee

New paragraph

Beneficiaries

Beneficiaries of the ten-year guarantee

The ten-year guarantee benefits:

- To the owner,

- To successive buyers,

- To the trade union association,

- To the syndicate of co-owners.

The contracting authority is the person on whose behalf the work is carried out.

It can be the owner of the land on which the work will be built or the holder of a building right.

It is also the purchaser of housing in a future state of completion. In fact, upon delivery of the work, he receives the right to ten-year action for the period remaining to run since receipt.

The new owner acquires, with the work, the ten-year guarantee which is considered as an accessory to the thing sold. However, by assigning the work, the initial contracting authority retains the right to exercise the ten-year guarantee action, if there is still interest.

This is the case when the buyer has made a claim against him based on the warranty against hidden defects.

In a housing estate, the trade union association responsible for the management and conservation of collective facilities is eligible to initiate the action for ten-year liability.

The syndicate of co-owners can exercise the ten-year action for the disorders of the common parts. The co-owners must act individually for the disorders of the private parts. The union can also take action to obtain compensation for the private portions if the origin of the disorders is in the common portions.

Nature of damage

Nature of damage covered and excluded by the ten-year guarantee

The damages which engage the ten-year liability are

those who compromise the solidity of the house, for example: serious cracks in the walls, significant sagging of the paving, a structural collapse;

make it unfit for its intended purpose (preventing all or part of the dwelling, for example);

affect the strength of the items of equipment forming part of the viability, foundation, framework, enclosure and cover works: water infiltration through the roof, through the facade, broken pipe embedded in a floor.

Structural damage insurance does not cover lack of maintenance or misuse of the house.

The client must:

regularly maintain exterior wooden structures (windows, awnings, etc.);

ensure that channels and gutters are not blocked by leaves;

avoid caulking ventilation systems;

regularly empty the septic tank.

If a serious fault appears following a lack of maintenance, the owner is responsible for it. No compensation based on structural damage insurance will then be possible.

Structural damage insurance

Scope of compensation by structural damage insurance

The compensation must allow the victim to rebuild the damaged structure or part of the structure. The work must be refurbished, as if the damage had never occurred.

But the repair is limited to the cost declared for the house in the insurance contract and discounted.

In the event of a dispute, the trial judges have a sovereign appreciation of the extent and methods of compensation for the damage. They are not required to follow expert reports.

The amount of the repair includes VAT, if this is paid definitively by the client.

Compulsory insurance does not include "loss of use" and "loss of rent" guarantees. It is however possible to request by extension of the "damage to work" contract a guarantee for non-material damage.

Whatever their importance, and even if they are without any measure with the repair work of the guaranteed damage, the cost generated by the work of demolition, clearing, removal or dismantling is covered by the compulsory insurance guarantees.

However, to be covered in this way, this work must constitute an essential accessory to the repair.

There is no deductible in construction damage insurance contracts.

Declaration of loss in the event of damage within ten years

In the event of damage, the claim describing the damage must be made by registered letter with acknowledgment of receipt, within the time limits provided for in the contract.

The most commonly accepted period is five days from knowledge of the loss.

The claim declaration is deemed to have been made if it contains at least the following information:

- the number of the insurance contract and, where applicable, that of the rider;

- the name of the owner of the damaged structure;

- the address of the building; the date of receipt or, failing that, the date of the first occupation of the premises;

- the date of appearance of the damage as well as their description and location.

From receipt of the claim, the insurer has 10 days to notify the insured that the claim is not deemed to have been made and to request the missing information.

The insurer has the choice of appointing or not an expert.

When the insurer does not respect the period of 60 days from receipt of the declaration of loss, to notify the insured of its decision on the principle of bringing into play the guarantees provided for in the contract. During this period, the insurer must appoint an expert to observe, describe, assess the damage and draw up a preliminary report. In view of this preliminary report, the insurer notifies the insured of its decision as to the principle of bringing into play the guarantees of the contract. The insurer communicates the preliminary report to the insured, before or at the latest during this notification.

The insurer may not appoint an expert if it considers that the damage is for an amount less than € 1,800 or that it does not constitute damage covered by the insurance.

In this case, he notifies the insured of his offer of indemnity or of his refusal of cover within fifteen days of receipt of the claim. If the insured does not agree, he can obtain the appointment of an expert.

If an expert is appointed, his role is to observe, describe and assess the damage.

Expertise operations are carried out in a contradictory manner. The insured may be assisted or represented. Any observations made by the insured are recorded in the expert's report.

Insurance experts and construction workers whose responsibility could be retained are present at this expert appraisal.

The insurer's silence within 60 days of receipt of the claim entails the acquisition of the guarantee. The insured is authorized to make the expenses within the limit of the amounts he himself estimated.

The protective measures recommended by the expert appraisal

At the end of the expertise, the expert draws up a preliminary report which indicates the precautionary measures to be taken to avoid the aggravation of the disorder.

It contains the analysis of the damage, which allows the insurer to decide on the opening of the insured's right to the guarantee. It includes an estimate of the cost of the recommended work.

At the end of the preliminary report, the insurer decides on the right to the guarantee. He must justify any decision to refuse compensation.

The insurer, who accepts the involvement of the guarantees, has 90 days from receipt of the declaration of the loss to present an indemnity offer, which is provisional in nature, intended for the payment of the damage repair work.

In the event of exceptional difficulties due to the nature or extent of the loss, the insurer may, at the same time as it notifies its agreement on the application of the guarantees, offer the insured an additional period for the establishment of the compensation offer.

The proposal must be reasoned and be based exclusively on technical considerations.

The additional period is subject to acceptance by the contracting authority and may not exceed 135 days.

If the insured accepts the offer made to him, the compensation is paid within 15 days of acceptance.

If the insured refuses the offer made to him:

he notifies the insurer of his disagreement, by registered letter with acknowledgment of receipt;

at the same time as his disagreement, he can have repairs undertaken for the amount he himself had established, and benefit as an advance from the payment of three quarters of the amount of compensation notified by the insurer. This advance, fixed and not subject to revaluation, to be applied to the final amount of the compensation which will be charged to the insurer, is paid in one go within a maximum of 15 days from receipt, by the insurer, of the request of the insured.

For any dispute concerning the insurance, in particular the refusal by the insurer to cover the claim, the contracting authority must refer the matter to the Tribunal de Grande Instance for the location of the building.

The expert's final report establishes the definitive measures to be taken to obtain full repair of the disorders, as well as their estimate.

The compensation is updated and revalued to take into account the difference between the date on which it is assessed and the date on which the payment will be made.

The amount of the indemnity is broken down between the cost of the work and the ancillary costs, taking into account, where applicable, the costs already advanced and the provisional indemnity that has been paid.

The purchase of structural damage insurance

Any natural or legal person who has deconstruction work carried out as owner of the structure, agent or seller, must take out damage insurance before the opening of the site.

The persons required to take out structural damage insurance include:

- Property managers and co-ownership trustees,

- The owner: subscriber of a contract for the construction of a single-family house, owner who builds himself (beaver), syndicate of co-ownership,

- The seller of buildings to be built,

- The real estate developer,

Structural damage insurance must be taken out no later than the date of establishment of the regulatory declaration of opening of the site.

In the event that a person subject to the obligation to insure is opposed to a refusal of insurance from an insurance company approved to take charge of this risk, he may refer the matter to the Central Office of Pricing (BCT). To contact the BCT, the client must send a letter by registered letter with acknowledgment of receipt to his insurer to request damage insurance. The latter's silence for 45 15 days from receipt of the letter is deemed to be refusal. With proof of this implicit refusal (or of an explicit refusal), the client contacts the BCT

The Central Bureau of Pricing has the exclusive role of fixing the amount of the premium through which the insurance company is required to cover the risk offered to it.

It can determine the amount of a deductible in the event of a claim which will remain the responsibility of the insured.

DO insurance default

Failure of structural damage insurance and / or liability insurance

In the event of damage falling under the builder's ten-year guarantee, the client who has not taken out damage-to-work insurance must contact the main company or its insurer directly, which intervenes under certain conditions. . But the deadlines for settling the case are longer than if he had taken out damage-to-work insurance.

He must wait for the expert, appointed, in most cases, for all the contractors, to determine the responsibilities.

The insurer of the company declared responsible then indemnifies the owner.

In the absence of structural damage insurance and liability insurance, the contracting authority's sole action will be against the builder presumed responsible for all damage covered by the ten-year guarantee.

However, in the event of financial failure of the insurance company, a guarantee fund for compulsory damage insurance was set up in 2003 to protect, under certain conditions, the insured persons, subscribers, members or beneficiaries of contract services. insurance whose subscription is made compulsory by a legislative or regulatory provision.

Intermediate damage

These are disorders that appeared after acceptance and which do not meet the conditions necessary to be covered under the ten-year guarantee (they do not compromise the solidity of the structure and do not make it unfit for its intended purpose) .

Home page

Case law has admitted that they can give rise to an action for compensation for ten years on the basis of contractual liability under common law.

Since the law of June 17, 2008 reforming the prescription in civil matters, these disorders should come under the responsibility of the builders (article 1792-4-3 of the civil code) which lapses 10 years after receipt.